Dubai’s Real Estate Market: A Realm of Opportunity

Dubai’s real estate market presents a kaleidoscope of opportunities for investors worldwide. Known for its rapid growth and architectural innovation, Dubai has established itself as a beacon of modern urban development. The city’s skyline, a mosaic of towering skyscrapers and luxury residences, symbolizes not just its architectural prowess but also its thriving real estate sector. This market is characterized by its resilience, diversity, and ability to attract international investors. Its strategic location as a crossroad between the East and West, coupled with its status as a business and tourism hub, further bolsters its appeal in the global real estate arena.

Real Estate Investment Trusts (REITs): An Investment Revolution

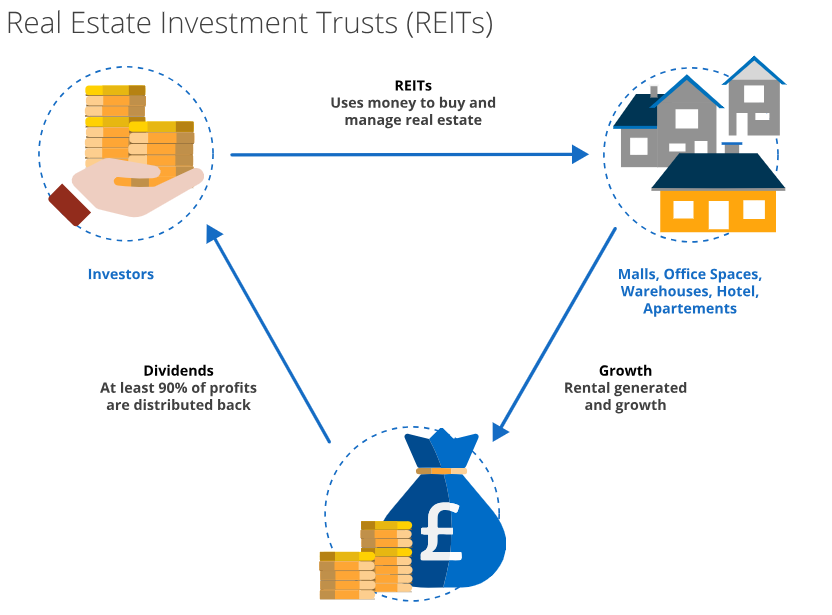

REITs represent a revolution in real estate investment, providing a bridge between high-value real estate and individual investors. They operate by pooling funds from investors to purchase, manage, and operate income-generating properties. This structure democratizes access to real estate investment, allowing individuals to earn dividends from real estate without the need to directly purchase or manage property. REITs typically focus on a range of property sectors, including commercial, residential, healthcare, and retail. They offer the unique advantage of liquidity, as shares in REITs are traded on major stock exchanges, making them as easy to buy and sell as stocks.

The Blog’s Mission: Illuminating the Path to Profit with Dubai REITs

The purpose of this blog is to illuminate the intricacies of investing in Dubai’s REITs. It aims to serve as a comprehensive guide for both seasoned investors and newcomers, offering insights into maximizing profits in this dynamic sector. The blog will delve into the nuances of REITs, compare them with traditional real estate investments, and provide practical advice on navigating the Dubai REIT market. By the end of this guide, readers will be equipped with the knowledge and strategies needed to make informed and profitable investment decisions in the Dubai REIT landscape.

Understanding REITs

REITs Unveiled: A Gateway to Real Estate Investment

REITs have redefined real estate investment, making it accessible to a broader range of investors. At their core, REITs are companies that own, operate or finance income-generating real estate. They offer a unique investment proposition: the opportunity to invest in portfolios of real estate assets, which could include anything from office buildings and apartments to shopping centers and hotels. This allows investors to earn a share of the income produced through real estate investment – typically through dividends – without having to buy, manage, or finance any properties directly.

The Global Journey of REITs: From Niche to Mainstream

The concept of REITs originated in the United States in the 1960s as a way to allow individual investors to participate in the commercial real estate market. Since then, REITs have undergone a remarkable evolution, expanding globally and becoming a mainstream investment vehicle. They have opened up the real estate sector to small and individual investors, previously a playground for the wealthy and institutional investors. The growth of REITs is a testament to their appeal – offering diversification, regular income streams, and liquidity, attributes not commonly associated with traditional real estate investment.

Dubai’s REIT Ecosystem: Growth and Prospects

In Dubai, the emergence of REITs is relatively recent compared to their global journey, but their impact has been significant. Dubai’s foray into the REIT market aligns with its vision of becoming a leading global financial center. The city has rapidly developed a robust REIT ecosystem, attracting a diverse range of investors with its innovative real estate projects and investor-friendly regulations. The current landscape of Dubai REITs includes a mix of residential, commercial, and even industrial properties, offering a variety of investment opportunities. This section of the blog will explore the history, current status, and prospects of REITs in Dubai, providing readers with a comprehensive understanding of this vibrant market

Advantages of Investing in Dubai REITs

Portfolio Diversification: Spreading Your Investment Wings

One of the most compelling reasons to invest in Dubai REITs is the opportunity for portfolio diversification. REITs allow investors to spread their exposure across various real estate assets. This diversification can reduce risk, as it mitigates the impact of volatility in any single property or market segment. For example, an investor in a Dubai REIT might have exposure to both luxury residential properties in Downtown Dubai and commercial spaces in the expanding outskirts, balancing risk and potential return.

Opening Doors for Smaller Investors: The Power of Accessibility

Dubai REITs stand out for their accessibility, especially for smaller investors. They offer a more affordable entry point into the real estate market, compared to the substantial capital required for direct property investment. This democratization of real estate investment means that more people can participate in and benefit from the growth of Dubai’s real estate market. With REITs, even those with limited capital can own a piece of Dubai’s iconic properties and earn dividends from these investments.

Regular Income Streams: The Dividend Advantage

One of the primary attractions of investing in REITs is the potential for regular income through dividends. Dubai REITs are particularly known for their generous dividend policies, often resulting in higher yields than other investment types. These dividends are typically distributed from the rental income generated by the REIT’s properties, providing investors with a steady income stream. This feature makes Dubai REITs an attractive option for income-focused investors, including retirees seeking regular cash flow.

REITs vs. Traditional Real Estate: A Comparative Perspective

Investing in Dubai REITs offers several advantages over traditional real estate investments. REITs provide ease of entry, liquidity, and the ability to spread risk across multiple properties – features not typically associated with direct real estate investment. Traditional real estate investment often involves significant capital outlay, management responsibilities, and a lack of liquidity. In contrast, REITs offer a hands-off investment experience with the added benefit of being able to buy and sell shares easily, much like stocks. This section of the blog will delve deeper into these differences, helping readers understand why Dubai REITs might be a more suitable investment option for their needs.

Enhanced Liquidity: The Flexibility of REITs

A key advantage of Dubai REITs over traditional real estate investments is their liquidity. REITs are traded on stock exchanges, allowing investors to buy and sell shares with ease, much like stocks. This contrasts sharply with the illiquidity of direct real estate, where selling a property can be a lengthy and complex process. The ability to quickly liquidate investments in REITs provides flexibility and peace of mind for investors, especially those who may need to access their funds on short notice. This liquidity also allows investors to respond swiftly to market changes, taking advantage of opportunities or mitigating risks as they arise.

Hassle-Free Management: The Convenience of REITs

Another significant difference between Dubai REITs and traditional real estate is the management aspect. When investing in REITs, investors are freed from the burdens of property management, maintenance, and tenant relations. These responsibilities are handled by professional management teams, allowing investors to enjoy the benefits of property ownership without its operational headaches. This is particularly appealing for those who want exposure to real estate but lack the time, expertise, or inclination to manage properties themselves.

Market Dynamics: Volatility and Pricing

Dubai REITs exhibit different market dynamics compared to traditional real estate. While REITs can be more sensitive to market fluctuations due to their stock-like nature, they also offer the potential for quicker price adjustments and capital appreciation. Traditional real estate, on the other hand, tends to have slower price movements but can provide stability and long-term capital gains. Understanding these dynamics is crucial for investors in making informed decisions. This section of the blog will explore how market volatility and pricing dynamics affect Dubai REITs differently from traditional real estate investments, helping investors navigate these complexities.

Tax Implications

Navigating the Tax Landscape of Dubai REITs

Understanding the tax implications is a critical component of investing in Dubai REITs. Dubai’s tax framework for REITs is investor-friendly, featuring various incentives and exemptions that enhance the appeal of these investments. For instance, REITs in Dubai may benefit from reduced or waived property transfer taxes and corporate income taxes, making them an attractive investment vehicle from a tax perspective.

Tax Benefits for REIT Investors

Investors in Dubai REITs can enjoy several tax advantages, contributing to the overall attractiveness of these investments. The potential for tax-efficient income through dividends is a significant draw. Furthermore, the absence of capital gains tax in Dubai means that profits from the sale of REIT shares are not taxed, enhancing the potential returns for investors. This favorable tax environment is a key factor in making Dubai REITs an appealing choice for both local and international investors.

International Investors: Tax Considerations

For international investors, understanding the tax implications in their home country is also crucial. While Dubai offers a tax-friendly environment for REITs, investors may be subject to taxation in their country of residence. This section will provide insights into the tax considerations for international investors, including double taxation agreements and withholding tax implications, ensuring that they can make the most informed decisions about their investments in Dubai REITs.

Risk Assessment

Identifying Risks in REIT Investments

Investing in REITs, like any investment, comes with its set of risks. Investors must understand and assess these risks before diving in. The risks associated with Dubai REITs can include market volatility, changes in interest rates, and fluctuations in property values. Additionally, the performance of a REIT is closely tied to its management’s expertise and the quality of its property portfolio. Understanding these risks is key to making informed investment decisions.

Economic Factors Influencing Dubai REITs

The performance of Dubai REITs is not isolated from broader economic factors. Changes in the global and local economy, such as fluctuations in oil prices, tourism trends, and construction activity, can impact the real estate market and, by extension, REITs. Furthermore, regulatory changes and geopolitical events can also play a role in influencing the market. This section of the blog will delve into the economic factors that can affect Dubai REITs, providing readers with a comprehensive view of the external influences that can impact their investments.

Strategies for Mitigating Risks

While risk is an inherent part of investing, there are strategies that investors can employ to mitigate these risks. Diversification within the REIT portfolio, thorough research, and staying informed about market trends are key strategies. Additionally, consulting with financial advisors and considering long-term investment horizons can also help in managing risk. This section will provide practical advice and strategies for investors to minimize their exposure to risk while maximizing their potential returns in Dubai REITs.

Expert Insights

Gleaning Wisdom from Financial Experts

To provide a well-rounded perspective on Dubai REITs, this section taps into the expertise of financial professionals specializing in this area. These insights will include interviews with industry experts, offering their views on the current state and prospects of REITs in Dubai. Their professional opinions, combined with years of experience, can give investors a deeper understanding of the market, helping to inform smarter investment choices.

Analyzing Market Trends and Future Projections

Understanding where the market is heading is crucial for any investor. This part of the blog will analyze current market trends in Dubai REITs and provide projections for their future. This includes examining factors like emerging real estate hotspots in Dubai, shifts in investor preferences, and potential regulatory changes. By staying abreast of these trends, investors can better position themselves to take advantage of upcoming opportunities and avoid potential pitfalls.

Case Studies

Success Stories in Dubai REITs

Learning from real-life examples can be incredibly valuable. This section will showcase a series of case studies detailing successful investments in Dubai REITs. These narratives will provide insight into what made these investments successful, including strategic decision-making, timing, and the selection of specific REITs.

Analysis and Lessons Learned

Each case study will be accompanied by an analysis highlighting the key factors that contributed to its success. This analysis will break down complex investment strategies into understandable concepts, providing readers with practical knowledge they can apply. Lessons learned from these cases will serve as valuable takeaways for readers, helping them to replicate similar successes in their investment journeys.

Best Practices for REIT Investment

Drawing from these case studies, the blog will outline best practices for investing in Dubai REITs. This will include tips on research, risk assessment, portfolio diversification, and timing of investments. By adhering to these best practices, investors can enhance their chances of success in the dynamic world of Dubai REITs.

How to Get Started with Dubai REITs

Step-by-Step Guide for Beginners

For those new to this investment vehicle, this section will provide a step-by-step guide on how to start investing in Dubai REITs. From understanding the basics to executing your first investment, this guide will walk readers through the entire process, ensuring a smooth entry into the world of REITs.

Choosing the Right REITs for Your Investment

Not all REITs are created equal. This part of the blog will help investors understand how to choose the right REITs that align with their investment goals and risk tolerance. Factors such as the types of properties included, dividend history, and management track record will be discussed to aid in making informed decisions.

Resources and Tools for Investors

Investing successfully in REITs requires access to the right resources and tools. This section will provide a compilation of useful resources, including financial advisory services, investment tools, and educational materials, to help investors stay informed and make savvy investment decisions.

Conclusion

Recap of Key Points

This comprehensive guide has traversed the landscape of Dubai REITs, shedding light on their advantages, differences from traditional real estate, tax implications, risk factors, expert insights, real-life success stories, and practical steps to get started.

The Future of REITs in Dubai’s Real Estate Market

The future of REITs in Dubai looks promising. With the city’s ongoing development and its appeal as a global investment destination, REITs are poised to play a significant role in the growth of its real estate sector. Investors who are well-informed and strategic in their approach can find lucrative opportunities in this dynamic market.

Final Thoughts and Recommendations

For potential investors, the world of Dubai REITs offers exciting possibilities. By understanding the market, assessing risks, and applying the insights and strategies outlined in this blog, investors can confidently navigate this space and potentially reap significant rewards.

Meta Title: Unlocking the Potential of Dubai Real Estate: A Deep Dive into REITs

Meta Description: Explore the lucrative world of Dubai’s Real Estate Investment Trusts (REITs). Our comprehensive guide covers everything from the basics to advanced strategies for maximizing profits in this dynamic market.

Join The Discussion